Average U.S. national house prices have increased to record levels. Homeowners may view the current market as an excellent opportunity to sell. While the market is high, there are also indications that a correction may occur within the next few years. Selling near peak and waiting out a correction to buy at a lower price is a potentially profitable option. In pursuing such action, it is important to distinguish assumptions from facts in decision-making.

In my last blog post, “Real Estate

and the First Time Buyer,” I provided an assessment

of how the housing market arrived at its present state and explored possible

outcomes in the market in the coming two years.

It was written for the benefit of the first-time buyer. This

post builds upon that analysis and explores options for the high equity owner

thinking of selling.

There are many reasons to consider selling in the current

market. For example, one’s financial

portfolio may be disproportionately allocated to real estate due to the rise in

prices. Or one might be at the limit of

the real estate capital gain tax exclusion ($250,000 single or $500,00 couple). Selling now would restart the two-year

exemption timeline on the next house and save significant taxation. Maybe there were already plans to downsize or

retire or move to another job or make a vacation home or rental property into a

permanent residence.

There are too many scenarios to assess in this limited space. The

context of people’s lives and regional housing market conditions vary

considerably. So, the remainder of this

post will explore a single case study that can provide broad insight in many

scenarios.

For this analysis, assume the strategy is to sell in anticipation of a significant market decline, and to then reenter the market when a price correction occurs. This is a market timing scenario. To successfully accomplish this market timing strategy requires occupying temporary housing for up to two years awaiting the market correction. In an ideal situation the seller may own a vacation home or a vacant rental property they can occupy full time for the necessary period while they extract themselves from the market. Those without must rent and account for temporary housing costs while sitting out the market.

This strategy anticipates a significant housing market price

correction will occur in the coming two years.

There is debate among experts over whether a correction will occur,

when, and to what extent; however, there are increasing

numbers of reports pointing in that direction. Most do not anticipate a severe collapse such

as occurred in 2008; however, there is a growing

body of opinion that a significant correction may occur. Any national correction is expected to have

broad regional variation.

There is reason for concern that the U.S. economy is facing serious headwinds. Inflation and interest rates are on the rise

and many experts think the Federal Reserve is not handling these issues

well. Concerns

a recession is within two years are increasing. The Ukraine War and the Chinese Covid

lockdown are exacerbating supply chain issues.

The stock market is in correction

territory (down over 10%) and may potentially extend declines to Bear

Market territory (down over 20%). These

conditions may influence the housing market negatively but realize that

predicting the future is very risky.

Proceed with caution. Mitigate

risk by knowing your circumstance and regional market well.

Selling one’s home is a major undertaking. It has many implications for a family. The analysis here is financially focused, but the intangible

things – disruption of lifestyle and stress – may be more important and deserve

full consideration. Ultimately, the

decision will come to, “Is the potential gain of selling worth the risk and personal

disruption and stress of the process.”

Moving is considered one of the most stressful events in

life. Some folks have a lot of

experience with multiple home sales in their lifetime. They have developed a knack for organizing an

efficient moving cycle process. They

have reduced their inventory of “stuff” to be carted from place to place. They

know how to efficiently perform renovations and improvements, and their

experience in this activity has proven profitable in the past. They view the process as a creative

adventure. They enjoy new places and transforming houses.

At the other end of the spectrum are folks who have had one

or two homes in the past 30 years. They

may be recent empty nesters looking toward retirement or already have retired. Maybe their home needs updating, and they

have accumulated “stuff” throughout their house, garage, and maybe even a

rented storage unit. To them, selling may

seem a daunting task. But the record

market prices may represent the best opportunity in a lifetime to transition.

First, know that simply selling a home at a peak and buying

another equivalent home in the same market may be a losing proposition. That house down the street or across town is

also inflated. The transaction

costs (e.g. agent fees, taxes and other closing costs) for the house you

are selling may be seven percent or more of the sale price. There will be moving, storage, and temporary

housing costs. The house you buy will

have closing costs, updating, and furnishing requirements. If financing, there will be mortgage fees

and points. These new house transaction costs

may represent an additional five percent or more of the purchase price –

ensuring a loss.

The remainder of this post will use a case study of a

hypothetical house in Florida to analyze the financial implications. In this case, the hypothetical house is in the Naples market. The region has a high concentration of

retirees. Over 50% of houses are bought with cash.

Much of the housing stock is seasonal second and third home

accommodation. Despite a robust new home

builder presence, inventory is not keeping pace with demand.

A national moderation

of the market can result in much broader and more severe regional impact

based on circumstance and market type. CNBC reported on CoreLogic

data in 2011 that the Naples market suffered a 55% decline in prices following

the 2008 housing collapse. Is this

likely again? Probably not, but whatever

national average price correction occurs - it will likely be significantly

amplified in Florida – particularly if there is a recession and stock market

decline.

A conservative approach will be taken here and use three

scenarios for analysis: 1) A minor moderation of prices; 2) a 10% regional

average price decline; and 3) a 20% regional average price decline.

The first step is to determine accurately the Cost Basis of the house to be sold. Knowing this number is essential to

calculating capital gain tax implications.

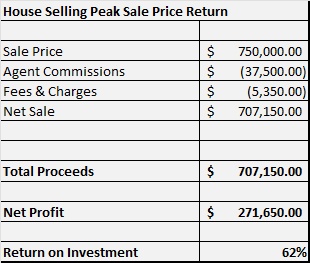

Start with the sale price. In

this hypothetical case it is $400,000.

Then add expenses for fees and closing costs and improvements allowed by

the Internal Revenue Service. Any costs of repairs or maintenance that are

necessary to keep your home in good condition but don’t add to its value or

prolong its life are not allowed. As

shown in the adjacent table “House Selling Cost Basis,” the Cost Basis of the

house rises to $437,000.

The fourth step is

to estimate the moving, storage, and temporary housing costs shown in the

tables below. Again, if one owns a

vacation home or vacant rental property that can be used for temporary lodging

while waiting for a market correction all the better both for convenience and

financial outcomes. But many folks will

need to rent an apartment or house for the waiting period. The table reflects a two-year temporary

housing period. Shorter periods may have

lower costs.

The fifth step is to estimate the savings that arise from

selling the original home. Operating a

home can be costly - particularly if there are high property taxes in the area

and if the home is part of a Homeowners

Association. The adjacent table, “House

Operating Costs Saved,” provides the estimated savings for a full two years.

The sixth step is to estimate the earnings from investing the proceeds of the sale of the house during the two-year waiting period. Given that the funds will be needed to purchase the new home within two years they will have to be invested in very conservative and liquid vehicles. The stock market is not a good place for these funds. It is best to deposit them in money market funds and short-term certificates of deposit. Rates in these accounts are on the rise, but for now can only be estimated at one percent return. Such a low return is disappointing, but the funds cannot be risked in the stock market and need to be available immediately when the market correction occurs, and a new house becomes available.

Having the detailed estimates of all costs of executing this

market correction strategy it is possible to project outcomes. To fully understand the implications of this

activity it is better to look at a ten-year time horizon. The table below shows three sale scenarios on

the left-hand column and three potential market outcomes across the top row

over a ten-year period.

To understand what the table, please look at the Market Slow

Down column. Under the No Sale scenario

in which we take no action and keep the original house for ten years that house

is projected to be worth $1,031,004.70 with low annual price increases going

forward over the next ten years. In the

next scenario where the original house is sold and the seller sits out the

market for six months, the projected value of the new house and any

savings/earnings from invested funds over ten years is $1,060.895.90 for a gain

of $29,891.20 over the period. In the

next scenario, where the original house is sold and the seller sits out the

market for two years, the projected value of the new house and savings/earnings

from invested funds over ten years is $1,076,207.40 for a gain of $45,202.70.

What is driving these returns?

First, the model assumes that the market correction is timed

right. The seller gets the maximum price

for sale of their existing home, sits out of the market to catch the

correction, and reenters to buy a house up to 20% less than it was previously valued. But

even if there is just a market slow down there is still a modest gain of $29,891.20

sitting out the market for six months and $45,202.70 sitting out for two years.

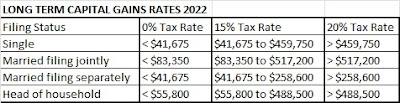

Some of the gain is largely driven by capital gains tax

savings. It is very important to understand

capital gains taxes on both real estate and investments. When a house is sold, the seller is liable

for capital gains taxes on the proceeds.

There is an exemption of up to $250,000 if single and $500,000 if a

couple when selling

real estate. The home must be your permanent residence and

you must have lived in it for two years.

In the case study, one can see that if the owner decides to stay in the

house for another ten years and then sell, the gain on the house exceeds the

$500,000 exemption. Capital gains taxes

will be due on that excess. Capital

gains taxes are typically 15% or 20% of the gain (see table adjacent). By selling the house now, the gain is less

than $500,000 and is fully exempt from tax. Again, have a complete understanding of

capital gains taxes if engaged in this activity.

DISTRIBUTION: Liberty Takes Effort shifted its distribution from social media to email delivery via Substack as a Newsletter. If you would like to receive distribution please email me at libertytakeseffort@gmail.com

DISCLAIMER: The entire contents of this website are based solely upon the opinions and thoughts of the author unless otherwise noted. It is not considered advice for action by readers in any realm of human activity. Its purpose is to stimulate discussion on topics of interest to readers to further inform the public square. Use of any information in this site is at the sole choice and risk of the reader.

No comments:

Post a Comment

Comments to blog postings are encouraged, but all comments will be reviewed by the moderator before posting to ensure that they are relevant and respectful. Hence, there will be a delay in the appearance of your comment. Thank you